When people hear the term “payday loan,” they often wonder, is a payday loan installment or revolving? These two terms—installment and revolving—are both used to describe types of credit or loans, but they work very differently. Understanding the difference helps you make smarter financial decisions and avoid costly mistakes.

In this guide, we’ll explain what “installment” and “revolving” loans mean, how a payday loan fits in, and the key differences between the two. You’ll also learn through simple examples, easy comparisons, and everyday explanations that even beginners can understand.

Let’s dive in and clear up the confusion once and for all!

What Does Each Term Mean?

Before understanding whether a payday loan is installment or revolving, let’s learn what each word means in simple English.

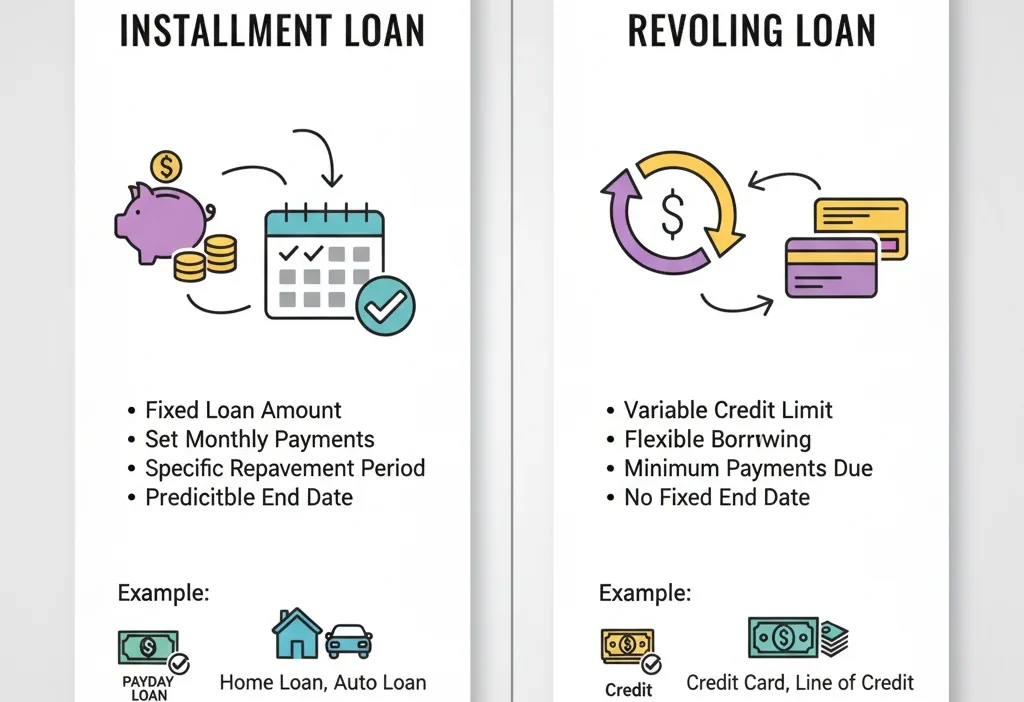

What Is an Installment Loan?

An installment loan means you borrow a fixed amount of money and repay it in set payments (installments) over a period of time—like months or years.

✅ Examples:

- A car loan that you pay off in 36 monthly payments.

- A student loan where you make fixed payments every month.

- A personal loan that you repay in 12 installments.

In short: You get all the money at once and pay it back gradually with interest until it’s fully repaid.

What Is a Revolving Loan?

A revolving loan (or revolving credit) allows you to borrow money again and again up to a set limit. Once you pay back some of what you borrowed, that amount becomes available to borrow again.

✅ Examples:

- A credit card (you can borrow, repay, and borrow again).

- A line of credit from your bank.

- A store credit account where you keep reusing the balance.

In short: It’s like a money tap—you can keep turning it on and off, as long as you stay under your limit.

The Key Difference Between Installment and Revolving Loans

Here’s a simple comparison table to make it easy to remember:

| Feature | Installment Loan | Revolving Loan |

|---|---|---|

| Borrowing Type | One-time lump sum | Continuous, reusable credit |

| Repayment | Fixed payments (monthly/weekly) | Flexible payments, depends on balance |

| Interest | Based on total borrowed amount | Based on amount used |

| Example | Car loan, personal loan | Credit card, line of credit |

| Reuse | Not reusable | Can be reused after repayment |

💡 Quick Tip to Remember:

Think of installment like installing payments in a row—you finish one after another until done.

Think of revolving like a revolving door—you can go in and out again and again!

So, Is a Payday Loan Installment or Revolving?

A payday loan is usually an installment loan, not revolving.

Here’s why:

- When you take a payday loan, you borrow a specific amount—say $500.

- You must repay it by your next payday or over a few fixed payments.

- Once you pay it off, you can’t borrow again automatically. You must apply for a new loan.

This makes it installment-based because it has a set amount, fixed repayment, and clear end date.

However, some lenders offer installment payday loans, where you can pay back in smaller chunks (like 4 or 6 installments). But none are revolving—you can’t reuse the credit line without reapplying.

✅ Example:

You borrow $400 on Monday. The lender asks you to repay it in two weeks. Once you pay it back, the loan ends.

That’s an installment loan, not revolving credit.

Common Mistakes People Make

Let’s look at a few common mix-ups and how to fix them:

❌ Mistake 1:

“Payday loans are like credit cards because I can borrow again anytime.”

✅ Fix: Payday loans end once repaid. You need a new application to borrow again.

❌ Mistake 2:

“Installment loans and revolving loans are the same.”

✅ Fix: Installment = fixed amount and fixed term. Revolving = ongoing access to credit.

❌ Mistake 3:

“All payday loans are revolving.”

✅ Fix: Payday loans are short-term installment loans, not revolving lines of credit.

When to Use an Installment Loan

Use an installment loan when you need a specific amount of money and want predictable payments.

✅ Examples:

- Paying for a car or motorcycle.

- Covering a large medical bill.

- Financing home repairs or furniture.

- Consolidating multiple debts into one loan.

💡 Tip: If you like fixed monthly payments and knowing when you’ll be debt-free, installment loans are the way to go.

When to Use a Revolving Loan

Use a revolving loan (like a credit card) when you need flexible access to money for changing needs.

✅ Examples:

- Managing daily expenses or emergencies.

- Shopping with a card that you repay monthly.

- Handling small, frequent purchases without reapplying.

💡 Memory Trick:

Imagine a revolving door—you can come in and go out anytime. Revolving credit works the same way!

Quick Recap: Installment vs Revolving

🔹 Installment Loan

- One-time lump sum

- Fixed payments over time

- Ends when balance is paid off

🔹 Revolving Loan

- Continuous borrowing up to a limit

- Flexible payments

- Can reuse credit after repayment

🔹 Payday Loan = Installment Loan, not revolving

Advanced Tips: Understanding Payday Loans Better

- Origin: Payday loans began as short-term loans meant to cover expenses until your next paycheck.

- In formal finance: Installment loans (like personal or auto loans) are more predictable, while revolving credit (like credit cards) helps build long-term credit history.

- Online confusion: Many websites use “installment” and “revolving” interchangeably, but they are not the same—especially for payday loans.

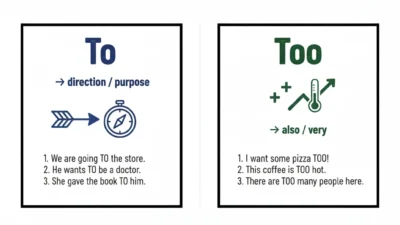

- Writing tip: When explaining these in essays or online, always say “Payday loans are short-term installment loans.” It’s grammatically and financially correct.

Mini Quiz: Test Yourself!

- A payday loan is usually ______ (installment / revolving).

- A credit card is an example of ______ credit.

- You borrow $300 and repay it in 3 fixed payments. That’s an ______ loan.

- You borrow money, repay it, then borrow again using the same account. That’s ______ credit.

- Installment means ______ (fixed payments / reusable balance).

(Answers: 1. installment, 2. revolving, 3. installment, 4. revolving, 5. fixed payments)

Frequently Asked Questions (FAQs)

Q1. Is a payday loan installment or revolving?

A payday loan is an installment loan because you borrow a set amount and repay it in fixed payments.

Q2. What’s the main difference between installment and revolving loans?

Installment = fixed payments for a fixed term. Revolving = flexible, reusable credit.

Q3. Can I reuse a payday loan like a credit card?

No. You must reapply once the payday loan is paid off.

Q4. Which type of loan helps build credit faster?

Both can help if managed wisely, but revolving credit (like credit cards) shows consistent usage history.

Q5. Are installment loans safer than payday loans?

Generally yes, because they have longer repayment terms and lower interest rates than payday loans.

Conclusion

Now you know the clear answer: A payday loan is an installment loan, not revolving credit.

You borrow a fixed amount, repay it in set payments, and the loan ends once it’s paid off.

Understanding the difference between installment and revolving loans helps you make smarter borrowing choices and avoid financial stress. Keep learning, stay curious, and remember—using the right term can make all the difference in your financial understanding!

Author’s Note:

Written by an English and finance enthusiast who loves making complex terms simple and easy to understand for everyone.

Polly Clark creates clear, insightful guides on language and usage, helping readers understand meanings, differences, and nuances with clarity and confidence.