A payday loan is usually an installment loan, not a revolving loan. You borrow a fixed amount and repay it in one payment or a few scheduled payments. Revolving loans work differently — you can borrow again and again up to a limit, like a credit card.

Many people ask, “Is a payday loan installment or revolving?” This question is common because loan terms can feel confusing, especially for beginners. Words like installment loan and revolving loan sound similar, but they mean very different things.

If you are borrowing money, planning a budget, or just trying to understand loan types, this guide is for you. We will explain what each term means, how payday loans work, and the key difference between installment and revolving loans.

Don’t worry — you do not need a finance degree to understand this article. Everything is written in plain English, with short sentences, real-life examples, and easy explanations. By the end, even a 4th-grade student will clearly understand the difference and know which type a payday loan really is.

What Does Each Term Mean?

Before we answer whether a payday loan is installment or revolving, let’s understand both terms one by one.

What Is a Payday Loan?

A payday loan is a small, short-term loan. People usually take it to cover urgent expenses, like bills or groceries, until their next paycheck.

Simple meaning:

You borrow a small amount of money and promise to pay it back soon.

Key features of a payday loan:

- Short repayment time (usually 2–4 weeks)

- Fixed amount borrowed

- Fixed repayment date

- Often higher interest or fees

Easy examples:

- You borrow $300 today and repay $350 on your next payday.

- You take a loan to fix your phone and pay it back in two weeks.

- You borrow once, repay once, and the loan ends.

What Is an Installment Loan?

An installment loan is a loan you repay in set payments over time.

Simple meaning:

You borrow money and pay it back in parts (called installments).

Part of finance:

Loan type (fixed repayment loan)

Easy examples:

- Borrow $600 and pay $200 every month for 3 months.

- A car loan with monthly payments.

- A personal loan paid back in equal parts.

Key idea:

Once the loan is paid off, it is finished.

What Is a Revolving Loan?

A revolving loan lets you borrow money again and again, up to a limit.

Simple meaning:

You can reuse the money after you pay some back.

Part of finance:

Credit-based loan

Easy examples:

- A credit card with a $1,000 limit.

- You spend $300, pay back $100, and can borrow again.

- You don’t need a new loan each time.

Key idea:

The loan keeps “revolving” as long as the account is open.

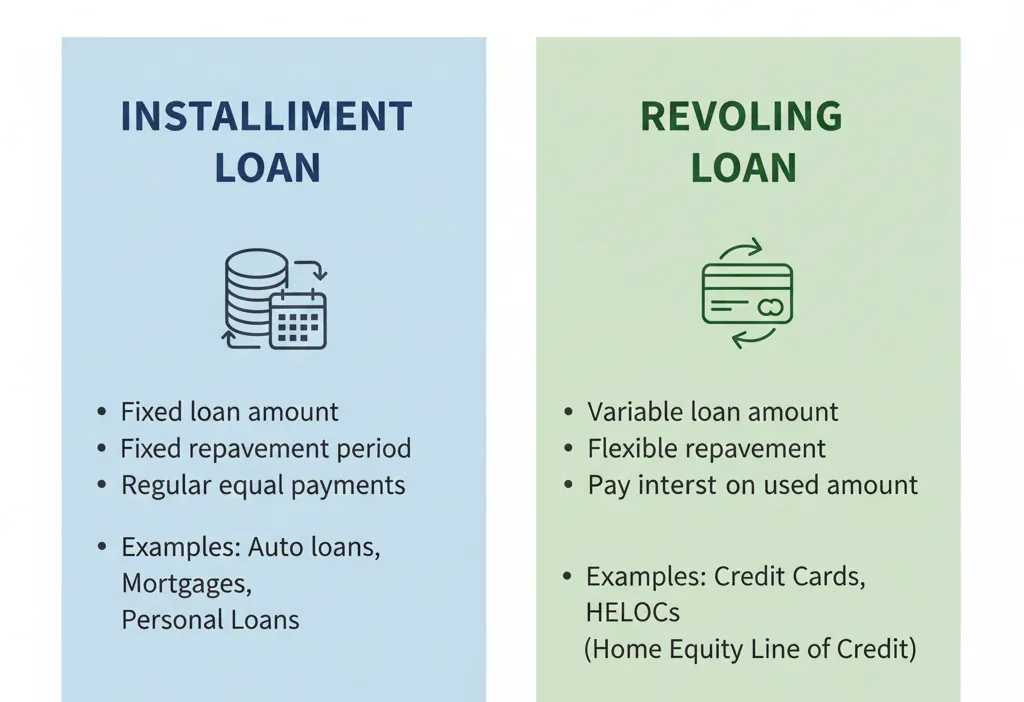

The Key Difference Between Installment and Revolving Loans

Now let’s clearly answer the main question:

Is a payday loan installment or revolving?

👉 A payday loan is an installment loan, not a revolving loan.

Comparison Table: Installment vs Revolving Loans

| Feature | Installment Loan | Revolving Loan |

|---|---|---|

| Borrowing | One-time amount | Borrow again and again |

| Repayment | Fixed payments | Flexible payments |

| Loan end | Ends after repayment | Ongoing |

| Example | Payday loan, car loan | Credit card |

| Reuse money | ❌ No | ✅ Yes |

Quick Tip to Remember:

If the loan ends after you pay it, it’s an installment loan.

If you can keep using it, it’s revolving.

Common Mistakes and How to Avoid Them

Many people make mistakes when answering “is a payday loan installment or revolving?” Let’s fix them.

Mistake 1: Calling a payday loan revolving

❌ “A payday loan works like a credit card.”

✅ Correct: A payday loan does not let you reuse money.

Why this happens:

People think all short-term loans work the same.

Mistake 2: Thinking installment means long-term only

❌ “Installment loans are always for years.”

✅ Correct: Installment loans can be short or long.

Why this happens:

People connect installment loans only with big loans.

Mistake 3: Mixing payment flexibility

❌ “I can pay some and borrow more.”

✅ Correct: That is revolving, not payday lending.

How to avoid mistakes:

Ask one question: Can I borrow again without a new loan?

When Is a Payday Loan an Installment Loan?

A payday loan fits the installment loan category in these situations:

- You borrow a fixed amount

- You repay on one date or in set payments

- You cannot reuse the loan

- The loan closes after payment

Simple real-life examples:

- You borrow $400 and repay $440 in two payments.

- You take a payday loan and pay it off in 30 days.

- Once paid, you must apply again to borrow more.

- The loan agreement ends after repayment.

- No credit line stays open.

Bottom line:

This is how installment loans work.

When Is a Loan Revolving?

A loan is revolving when it works like this:

- You have a credit limit

- You can borrow multiple times

- Paying back frees up credit

- No fixed end date

Easy examples:

- A credit card you use every month.

- A line of credit for emergencies.

- You borrow, repay, and borrow again.

Memory Hack:

Revolving loans are like a water bottle.

You can refill it again and again.

Quick Recap: Installment vs Revolving

- Payday loans = Installment loans

- Installment loans: borrow once, repay, done

- Revolving loans: reuse money many times

- Payday loans do not keep credit open

- Credit cards are not payday loans

Advanced Tips (Optional)

Short History

- Installment loans have existed for hundreds of years.

- Revolving credit became popular with credit cards in the 1900s.

Formal Writing and Exams

In exams or finance writing:

- Use “installment loan” for payday loans

- Never label payday loans as revolving credit

Online and Texting Mistakes

Online posts often misuse terms.

Wrong wording can confuse readers or cause legal trouble.

Mini Quiz: Test Yourself

Fill in the blanks:

- A payday loan is an __________ loan.

- A credit card is a __________ loan.

- Installment loans have __________ payments.

- Revolving loans allow you to __________ money again.

- A payday loan ends after __________.

Answers:

- installment

- revolving

- fixed

- borrow

- repayment

Conclusion

Now you clearly know the answer to “is a payday loan installment or revolving?” A payday loan is an installment loan because it has a fixed amount, a fixed repayment plan, and a clear end date. Revolving loans work differently and allow repeated borrowing, which payday loans do not.

Understanding this difference helps you make smarter financial choices and avoid confusion when reading loan terms. Keep learning, keep asking questions, and remember — improving your financial knowledge happens one simple step at a time.

❓ (FAQs)

1. Is a payday loan considered revolving credit?

No. A payday loan is not revolving credit. It is an installment loan.

2. Can payday loans have multiple payments?

Yes. Some payday loans are paid in short installments.

3. Are installment loans safer than revolving loans?

They are easier to track because payments are fixed.

4. Is a credit card a payday loan?

No. Credit cards are revolving loans.

5. Why do people confuse installment and revolving loans?

Because both involve borrowing money, but they work differently.

Polly Clark creates clear, insightful guides on language and usage, helping readers understand meanings, differences, and nuances with clarity and confidence.