👉 A small business loan can be secured or unsecured — it depends on whether you provide collateral.

If you give an asset (like property or equipment), it’s secured.

If you don’t give any asset, it’s unsecured.

This guide explains the difference in the simplest way possible, with real-life examples anyone can understand.

Many people ask the same question again and again: “Is a small business loan secured or unsecured?”

The confusion happens because both types exist, and banks don’t always explain them clearly.

If you are starting a business, running a shop, or planning to expand, choosing the wrong loan can cost you money and stress. Some loans need collateral, while others don’t. Some have low interest, others have higher interest.

Don’t worry.

This guide will explain secured vs unsecured small business loans in plain English.

No banking jargon.

No confusing terms.

By the end, even a 4th-grade student can understand:

- What secured means

- What unsecured means

- The key difference

- When to use each one

- Common mistakes to avoid

Let’s make business loans simple 👍

What Does Each Term Mean?

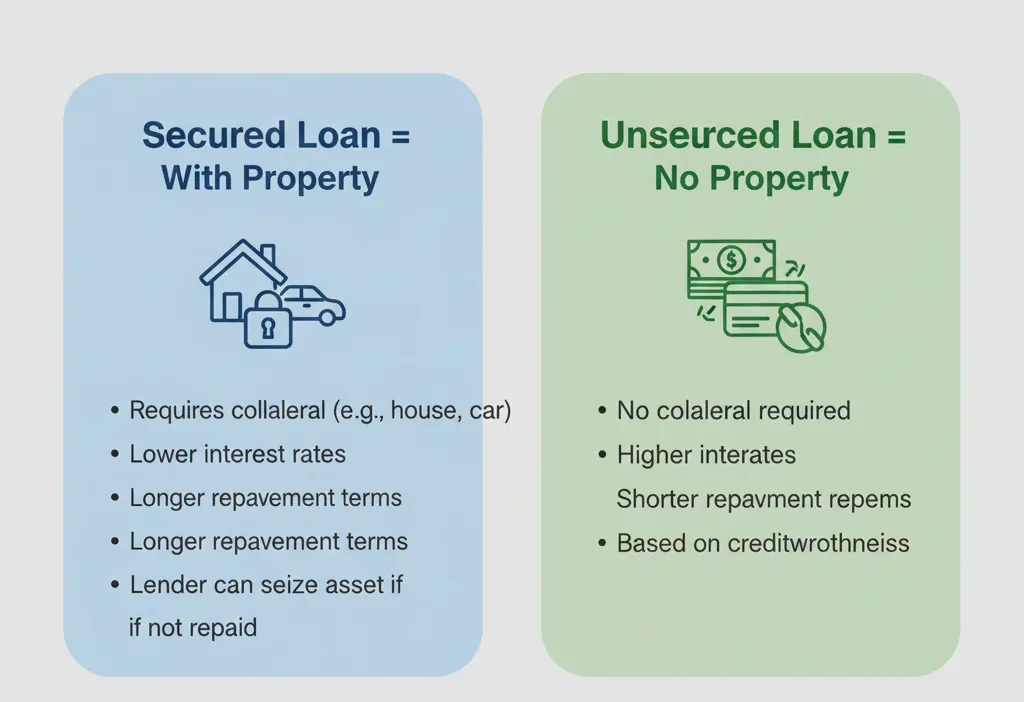

✅ What Is a Secured Small Business Loan?

A secured small business loan is a loan backed by collateral.

Collateral means something valuable you own, such as:

- Property or land

- A car or vehicle

- Business equipment

- Fixed deposit or savings

If you cannot repay, the lender can take that asset.

Simple Meaning:

👉 Loan with security

Easy Examples:

- You give your shop as security and get a loan.

- A bank takes your land papers before approving the loan.

- You use machinery as collateral for business money.

Think of it like this:

It’s like borrowing money from a friend and giving them your phone until you return the money.

✅ What Is an Unsecured Small Business Loan?

An unsecured small business loan is a loan without collateral.

You don’t give:

- Property

- Car

- Equipment

The bank trusts your:

- Income

- Credit history

- Business performance

Simple Meaning:

👉 Loan without security

Easy Examples:

- You get a loan based only on bank statements.

- Online business loan with no assets required.

- Short-term loan approved quickly without property papers.

Think of it like this:

It’s like borrowing money from a close friend who trusts you — no item needed.

🔍 The Key Difference Between Secured and Unsecured Small Business Loans

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required | Not required |

| Risk for lender | Low | High |

| Interest rate | Lower | Higher |

| Approval speed | Slower | Faster |

| Loan amount | Higher | Lower |

| Credit score importance | Medium | Very important |

Quick Tip to Remember:

👉 Security = Secured

👉 No security = Unsecured

Common Mistakes and How to Avoid Them

❌ Mistake 1: Thinking All Business Loans Are Unsecured

✅ Fix: Always ask if collateral is required.

❌ Mistake 2: Ignoring Interest Rates

Unsecured loans often cost more over time.

✅ Fix: Compare total repayment, not just approval speed.

❌ Mistake 3: Risking Important Property

Some people secure loans with their home.

✅ Fix: Use only assets you can afford to risk.

When to Use a Secured Small Business Loan

Use a secured loan when:

- You need a large amount

- You want lower interest

- You have valuable assets

- You plan long-term growth

Simple Example Sentences:

- I used land to get a secured business loan.

- A secured loan helped expand my factory.

- Banks prefer secured loans for big projects.

- Interest is low because collateral is provided.

Real-Life Example:

A shop owner gives shop papers to open a second branch.

When to Use an Unsecured Small Business Loan

Use an unsecured loan when:

- You don’t own assets

- You need money quickly

- You want less paperwork

- Loan amount is small

Simple Example Sentences:

- I got an unsecured loan online.

- No property was needed for approval.

- Interest is higher, but approval is fast.

- Startups often choose unsecured loans.

Memory Hack:

👉 “Unsecured = Unprotected = No Asset”

Quick Recap: Secured vs Unsecured Small Business Loans

- Secured loan: Needs collateral

- Unsecured loan: No collateral

- Secured = lower interest

- Unsecured = faster approval

- Choice depends on need and risk

Advanced Tips (Optional)

- Secured loans are better for long-term business plans.

- Unsecured loans are common in online lending platforms.

- In exams and interviews, always mention collateral difference.

- Wrong usage can lead to financial loss, not just grammar mistakes.

Mini Quiz (Test Yourself)

Fill in the blanks:

- A loan with property security is called a ______ loan.

- An unsecured loan does not require ______.

- Interest is usually lower in a ______ loan.

- Startups often prefer ______ loans.

- Collateral reduces lender ______.

(Answers: secured, collateral, secured, unsecured, risk)

FAQs

1. Is a small business loan secured or unsecured?

A small business loan can be secured or unsecured, depending on whether collateral is required.

2. Which is better: secured or unsecured business loan?

Secured loans are cheaper. Unsecured loans are faster. The best choice depends on your situation.

3. Do all banks offer unsecured business loans?

No. Many banks prefer secured loans, but online lenders offer unsecured options.

4. Can a startup get an unsecured business loan?

Yes, but good credit history is usually required.

5. Is collateral risky for small business owners?

Yes. If you fail to repay, you may lose the asset.

Conclusion

Now you clearly know the answer to “is a small business loan secured or unsecured?”

The truth is simple: it can be both.

If you give security, it’s a secured loan.

If you don’t, it’s an unsecured loan.

Both have pros and cons.

The smart choice depends on your business needs, assets, and risk level.

Keep learning.

Keep comparing.

Every small step improves your financial knowledge — and your business success 🌱

Jenn Ashworth offers clear, engaging explanations of language and usage, helping readers grasp meanings, nuances, and differences with accuracy and ease.