A secured loan requires something valuable (like a house or car) as security or collateral. An unsecured loan does not require any collateral. Secured loans are safer for lenders and usually have lower interest rates, while unsecured loans are riskier and usually have higher interest rates.

Many people get confused when they hear the terms loan secured or unsecured, especially beginners or those applying for a loan for the first time. Both phrases are common in banking, finance, and everyday conversations, but their meanings are not always clear. Because the words sound similar and are used together, people often mix up the difference between secured and unsecured loans.

This simple and friendly guide explains the meaning, correct usage, and key differences between secured vs unsecured loans using easy examples—even a 4th-grade student can understand.

By the end, you’ll know exactly when to use each term, how to remember them, and how they work in real-life situations like school, business, and daily life.

🟦 What Does a Secured Loan Mean?

A secured loan is a loan that requires something valuable as security, also called collateral.

If a borrower cannot repay the loan, the bank can take the item used as security.

✔ Part of Speech

- Secured loan is a noun phrase.

✔ Simple meaning

A loan backed by something valuable.

✔ Easy Examples

- “A house loan is a secured loan because the house is the collateral.”

- “My father took a secured loan using his car as security.”

- “Banks give secured loans at lower interest rates.”

✔ Mini Story

Imagine you borrow your friend’s bicycle. You give him your video game as security. If you return the bike, you get the game back. This is how secured loans work.

🟦 What Does an Unsecured Loan Mean?

An unsecured loan does not require any security or collateral.

The lender trusts you based on your income, job, and credit score.

✔ Part of Speech

- Unsecured loan is a noun phrase.

✔ Simple meaning

A loan without collateral.

✔ Easy Examples

- “Credit cards are unsecured loans because no collateral is required.”

- “Students often take unsecured loans for studies.”

- “Unsecured loans usually have higher interest rates.”

✔ Mini Story

Imagine you borrow a pencil from a classmate without giving anything in return. They trust you’ll return it. That’s an unsecured loan.

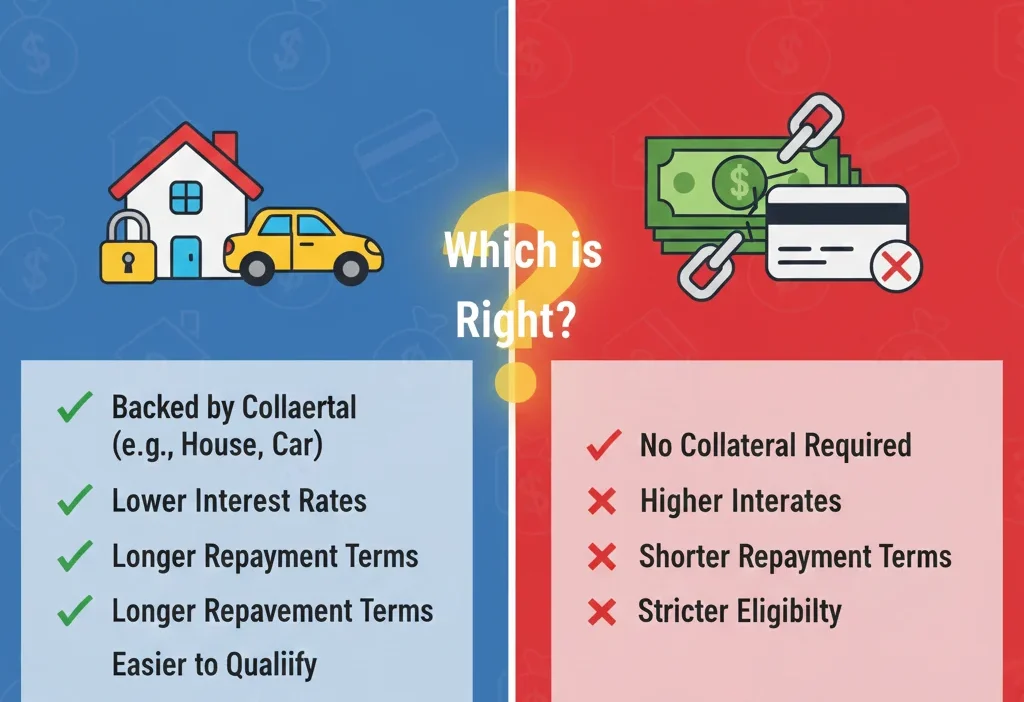

🟦 The Key Difference Between Secured and Unsecured Loans

Below is a simple comparison table:

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Required? | Yes | No |

| Interest Rate | Low | High |

| Risk for Lender | Low | High |

| Examples | Home loan, car loan | Credit card, personal loan |

| Who should use? | People with assets | People with no assets |

⭐ Quick Tip to Remember

- Secured = Safe for lender because something valuable is secured.

- Unsecured = Only your promise, no security.

🟦 Common Mistakes and How to Avoid Them

❌ Mistake 1:

“Credit cards are secured loans.”

✔ Correct: Credit cards are unsecured loans because they require no collateral.

❌ Mistake 2:

“Home loans are unsecured.”

✔ Correct: Home loans are secured loans because the house is the collateral.

Why These Mistakes Happen

Many learners don’t understand the word secured—it sounds like “safe,” so people think it means “safer for the borrower,” but actually it means safe for the lender.

🟦 When to Use ‘Secured Loan’

Use “secured loan” when talking about loans backed by valuable items.

✔ Examples

- “A car loan is a secured loan.”

- “Banks prefer secured loans because they are low-risk.”

- “The gold loan was approved quickly because it was secured.”

- “A mortgage is a type of secured loan.”

- “Farmers often take secured loans against land.”

⭐ Memory Hack

If something is “secured,” it is tied to something valuable.

🟦 When to Use ‘Unsecured Loan’

Use “unsecured loan” when no collateral is required.

✔ Examples

- “A personal loan is usually an unsecured loan.”

- “Students take unsecured education loans.”

- “A bank checks credit score before giving an unsecured loan.”

- “Businessmen sometimes use unsecured loans for quick expenses.”

- “Unsecured loans are faster because no security is needed.”

⭐ Memory Hack

“Unsecured” = “Untied.” Nothing is tied to the loan.

🟦 Quick Recap: Secured vs Unsecured Loan

- Secured loan → Needs collateral

- Unsecured loan → No collateral

- Secured loans = lower interest

- Unsecured loans = higher interest

- Secured loans are for people with valuable assets

- Unsecured loans are for people who need quick, collateral-free money

🟦 Advanced Tips (Optional)

- The word “secured” comes from the idea of safety or protection.

- In essays or exams, define each first, then compare.

- Misusing these terms can confuse lenders or readers.

- In online writing, “secured loan” and “unsecured loan” help readers make financial decisions.

🟦 Mini Quiz

Fill in the blanks:

- A home loan is a ______ loan.

- Credit cards are ______ loans.

- A loan without collateral is called an ______ loan.

- A loan backed by a car is a ______ loan.

- Unsecured loans usually have ______ interest rates.

🟦 5 FAQs

1. What is the main difference between a secured and unsecured loan?

A secured loan needs collateral, while an unsecured loan does not.

2. Which loan is safer?

Secured loans are safer for lenders, not borrowers.

3. Which loan has higher interest rates?

Unsecured loans usually have higher interest rates.

4. Is a student loan secured or unsecured?

Most student loans are unsecured.

5. What happens if I don’t pay a secured loan?

The lender may take the collateral (like a house or car).

🟦 Conclusion

Understanding the difference between a loan secured or unsecured is important for anyone planning to borrow money. Secured loans require collateral and offer lower interest rates, while unsecured loans are collateral-free but more expensive. Now you know the meaning, usage, examples, and differences in a simple way.

Keep practicing these terms in real-life conversations. The more you use them, the easier they will become. With this clear guide, you can confidently choose the right loan type and improve your English understanding at the same time.

Francis Sufford crafts thoughtful, insightful explanations on language, meaning, and usage, blending clarity with storytelling to guide readers effectively.