Many people often get confused between the phrases “loan secured” and “loan unsecured.” These financial terms look similar, sound related, and sometimes appear in the same place, such as bank forms, websites, or loan advertisements. Because of this, beginners often mix them up or use them incorrectly.

This easy guide will help you clearly understand the meaning, difference, and correct usage of loan secured / unsecured in simple English. Whether you are a student, a new learner, or someone trying to understand banking terms, this guide will make everything feel simple.

By the end of this article, you will know what each term means, when to use it, how to avoid mistakes, and how to remember the difference forever—even if you’re only in class 4.

What Does Each Phrase Mean?

1. What Does “Loan Secured” Mean?

Loan Secured means a loan that is protected by something valuable, like a house, car, gold, or property.

If you cannot pay back the loan, the bank can take that valuable item.

Part of Speech:

This phrase works as an adjective phrase describing the type of loan.

Simple Meaning:

A loan that needs a guarantee (security).

3 Easy Examples:

- My car is used as security for the secured loan.

- A secured loan usually has a lower interest rate.

- The bank asked for property papers for a loan secured by land.

2. What Does “Loan Unsecured” Mean?

Loan Unsecured means a loan that does not require any valuable item as security.

It is given based on your credit history, job, income, or trust.

Part of Speech:

Another adjective phrase describing a type of loan.

Simple Meaning:

A loan without any guarantee.

3 Easy Examples:

- A credit card bill is an unsecured loan.

- Students often take unsecured loans for studies.

- A personal loan is usually loan unsecured by assets.

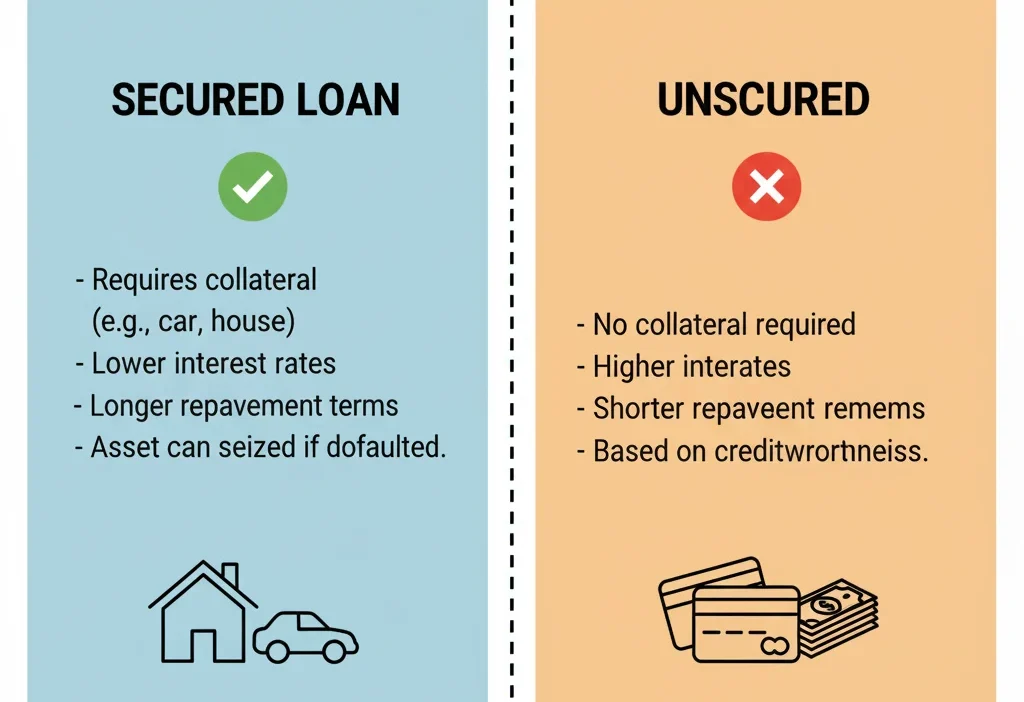

The Key Difference Between Loan Secured and Loan Unsecured

To understand clearly, here is a simple comparison:

| Feature | Loan Secured | Loan Unsecured |

|---|---|---|

| Security Needed? | Yes | No |

| Interest Rate | Lower | Higher |

| Risk for Bank | Low | High |

| Risk for Borrower | If unpaid, asset can be taken | No asset is taken |

| Common Examples | Home loan, car loan, gold loan | Personal loan, credit card loan |

| Sentence Example | “I applied for a secured loan with my car as security.” | “I got an unsecured loan without giving any asset.” |

Quick Tip to Remember

- Secured = Safe for the bank (because the bank has security).

- Unsecured = Unsafe for the bank (because there is no security).

Common Mistakes and How to Avoid Them

❌ Mistake 1:

“An unsecured loan means the bank gives you security.”

Why wrong: The word unsecured means no security.

✔️ Correct:

“An unsecured loan means you don’t give security to the bank.”

❌ Mistake 2:

“I took a loan secured without any asset.”

Why wrong: A secured loan always needs an asset.

✔️ Correct:

“I took an unsecured loan because I did not have an asset.”

❌ Mistake 3:

“Both secured and unsecured loans require collateral.”

Why wrong: Only secured loans require collateral.

✔️ Correct:

“Only secured loans require collateral.”

When to Use “Loan Secured”

Use loan secured when the loan requires security or collateral.

Use it in situations like:

- Buying a house

- Buying a car

- Using gold, property, or land to get a loan

- When the bank needs something valuable from you

Example Sentences:

- A home loan is a type of loan secured by property.

- Banks prefer a secured loan for large amounts.

- The gold was used for a loan secured by jewelry.

- A secured loan has lower risk for the bank.

- My land papers were required for a loan secured by assets.

When to Use “Loan Unsecured”

Use loan unsecured when the loan does not require collateral.

Use it in situations like:

- Personal loans

- Medical emergencies

- Education loans (sometimes)

- Credit card loans

- Any small loan without security

Example Sentences:

- A personal loan is usually loan unsecured by assets.

- The bank approved my unsecured loan quickly.

- Students often apply for an unsecured loan.

- I needed money urgently, so I took a loan unsecured by property.

- Credit card bills are a form of unsecured loan.

Memory Hack:

Think of UNsecured as UNlocked — nothing is locked or used as security.

Quick Recap: Loan Secured vs Loan Unsecured

- Loan Secured: Needs security (house, car, gold).

- Loan Unsecured: No security required.

- Secured = Lower interest

- Unsecured = Higher interest

- Secured loan protects the bank

- Unsecured loan depends on trust/credit score

Advanced Tips (Optional)

- The word secured comes from the idea of “being safe or protected.”

- The word unsecured simply adds “un,” meaning “not safe or not protected by an asset.”

- In formal writing, always use secured loan and unsecured loan instead of mixing the order.

- On exams or financial forms, mixing these terms can change the meaning completely.

- Online, people often shorten them to “secured” and “unsecured,” but the meaning stays the same.

Mini Quiz: Test Yourself

Fill in the blanks:

- A home loan is a ______ loan.

- A credit card loan is an ______ loan.

- A loan with no collateral is called ______.

- A loan protected by your car is a ______ loan.

- Students often take an ______ loan for education.

(Answers: secured, unsecured, unsecured, secured, unsecured)

FAQs

1. What is the main difference between a loan secured and unsecured?

A secured loan requires security or collateral, while an unsecured loan does not.

2. Which loan is safer for the bank?

A secured loan is safer because the bank has an asset as protection.

3. Which loan has higher interest rates?

Unsecured loans have higher interest rates because they are riskier for the lender.

4. Is a personal loan secured or unsecured?

Most personal loans are unsecured, meaning no collateral is needed.

5. Can a bank take your property in an unsecured loan?

No. Only secured loans allow the bank to take your asset if you don’t repay.

Conclusion

Now you clearly understand loan secured / unsecured, their meanings, differences, and correct usage in simple English. Secured loans need collateral, while unsecured loans depend on trust and credit history. Knowing this helps you use the terms correctly in daily life, writing, school exams, or financial decisions. Keep practicing these concepts, and your English—and financial knowledge—will get stronger every day.

Jenn Ashworth offers clear, engaging explanations of language and usage, helping readers grasp meanings, nuances, and differences with accuracy and ease.