Many people often confuse the terms mortgage and invest, even though they are very different. This happens because both words are related to money, finance, and planning, but they describe opposite actions. Understanding their meaning and correct usage is essential—not just for school or work, but for everyday conversations and financial decisions.

In this guide, we’ll break down what mortgage and invest mean, how they are different, and when to use each correctly. You’ll see clear examples, simple tips, and easy tricks to remember them. By the end, even beginners will feel confident spotting the right word in any sentence. Whether you’re writing an email, talking about buying a house, or planning your savings, this guide will make these words crystal clear.

What Does Each Word Mean?

Mortgage: Definition and Examples

A mortgage is a loan you take from a bank to buy property or a house. You promise to pay it back over time, usually with interest.

- Part of Speech: Noun (the loan itself) / Verb (to borrow against property)

- Simple Explanation: A mortgage is like borrowing money to get a house now and paying later.

Examples:

- I got a mortgage to buy my first home.

- She mortgaged her house to start a business.

- The bank approved his mortgage in just two weeks.

Memory Tip: Think “mortgage = money for a house.”

Invest: Definition and Examples

To invest means to put money into something (like stocks, a business, or property) with the hope that it grows over time.

- Part of Speech: Verb

- Simple Explanation: Investing is planting money now so it can grow later.

Examples:

- He invests in stocks to save for retirement.

- We invested in a small startup last year.

- She invested her savings wisely and doubled her money.

Memory Tip: Think “invest = grow your money.”

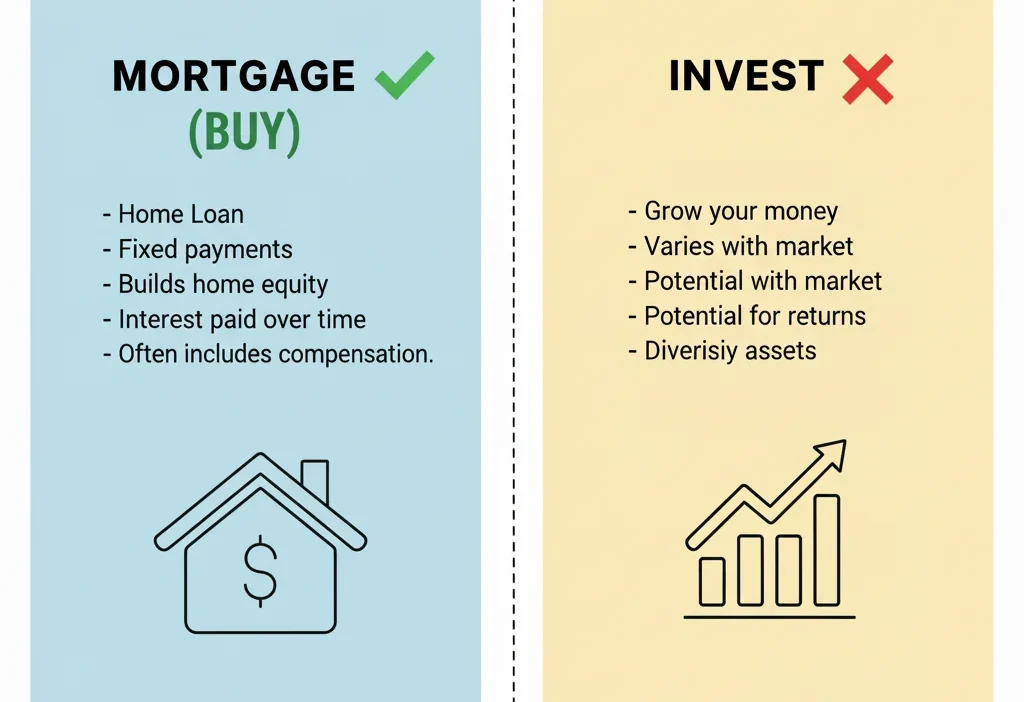

The Key Difference Between Mortgage and Invest

| Feature | Mortgage | Invest |

|---|---|---|

| Meaning | Borrowing money to buy property | Putting money to grow value |

| Part of Speech | Noun / Verb | Verb |

| Purpose | Own a home or property | Make money or profit |

| Example Sentence | I have a mortgage on my new apartment. | I invested in a mutual fund last year. |

| Quick Tip | Mortgage = debt you must repay | Invest = money you want to grow |

Quick Tip: Remember: Mortgage = owe | Invest = grow

Common Mistakes and How to Avoid Them

Mistake 1: “I invested a house from the bank.”

✅ Correct: “I got a mortgage for a house from the bank.”

Why: You don’t invest in a house by borrowing; a mortgage is the loan itself.

Mistake 2: “I mortgaged in the stock market.”

✅ Correct: “I invested in the stock market.”

Why: Mortgaging is for property, investing is for money growth.

Mistake 3: “She invested a mortgage to buy a car.”

✅ Correct: “She got a mortgage to buy a house.”

Why: Mortgages are specific to property, not general expenses.

When to Use Mortgage

Use mortgage when talking about loans or property purchases.

Examples:

- We need a mortgage to buy our first apartment.

- His mortgage interest rate is very low this year.

- She paid off her mortgage early.

- The bank refused his mortgage application.

- Our mortgage will be fully paid in 20 years.

Real-Life Situations: Buying a home, refinancing, or talking about property loans.

When to Use Invest

Use invest when you want your money to grow or gain value over time.

Examples:

- I invest $100 every month in a savings account.

- He invested in a new business idea.

- They invested in real estate to secure their future.

- She invests in education to improve her skills.

- We invested wisely and earned a good profit.

Memory Hack: Think of planting a seed (money) and watching it grow. That’s investing.

Quick Recap: Mortgage vs Invest

- Mortgage: Loan for buying property; you owe money.

- Invest: Put money into something to grow it.

- Mortgage tip: Always related to property.

- Invest tip: Can be stocks, business, or education.

- Easy Reminder: Mortgage = owe, Invest = grow.

Advanced Tips (Optional)

- Origin: Mortgage comes from Old French “morgage” meaning “dead pledge.” Invest comes from Latin “investire” meaning “to clothe or cover,” later used for putting money into something.

- Formal Writing: Use mortgage in financial documents; invest in business or academic essays.

- Online Usage: Misusing these terms in texting can confuse readers. Always use mortgage for loans and invest for financial growth.

Mini Quiz

Fill in the blanks:

- I __________ in stocks to save for college.

- They got a __________ to buy their first home.

- She plans to __________ in a startup this year.

- Our __________ will be fully paid in 15 years.

- He __________ his money in a retirement fund.

(Answers: 1. invest, 2. mortgage, 3. invest, 4. mortgage, 5. invested)

FAQs

1. Can I use mortgage and invest interchangeably?

No. Mortgage is borrowing money for property; invest is putting money to grow.

2. Is mortgage only for houses?

Yes, mortgages are specifically loans for property or real estate.

3. Can I invest in real estate?

Yes. Investing in real estate means buying property to earn profit, not borrowing.

4. Is investing risky?

Some investments are risky, like stocks, but long-term planning reduces risk.

5. How can I remember mortgage vs invest?

Think: Mortgage = debt, Invest = grow. Simple and visual.

Conclusion

Understanding the difference between mortgage and invest is easier than it seems. A mortgage is about borrowing money to buy property, while investing is about putting money into something to grow it. By remembering the simple tip—Mortgage = owe, Invest = grow—you can avoid common mistakes and use both words confidently. Practice with the examples in this guide, and soon you’ll naturally know which word fits any financial situation. Learning these small differences is a step toward mastering English and improving communication. Keep practicing, stay curious, and enjoy using new words correctly every day.

Francis Sufford crafts thoughtful, insightful explanations on language, meaning, and usage, blending clarity with storytelling to guide readers effectively.