👉 Most qualifying life events give you 60 days to enroll in or change health insurance.

👉 Some plans allow only 30 days, depending on your employer or insurer.

The rule is not the same everywhere, and missing the deadline can cost you coverage.

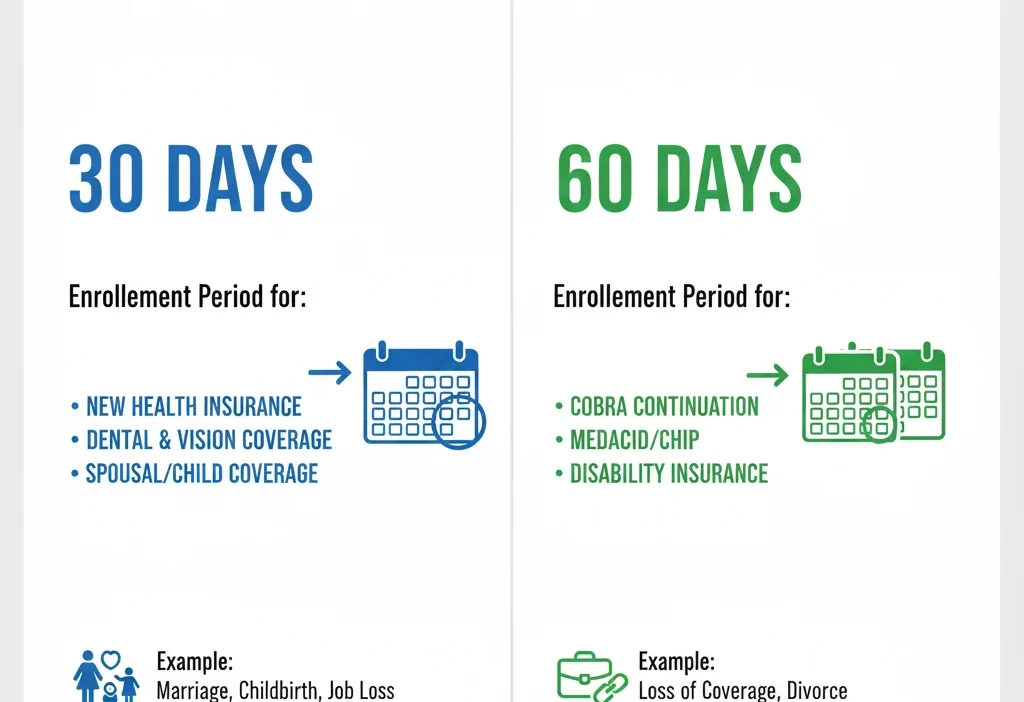

The phrase “qualifying life event 30 or 60 days” confuses many people. You may hear someone say, “You only have 30 days,” while another person says, “No, you get 60 days.” So which one is correct?

The truth is simple but important. Both 30 days and 60 days can be correct, depending on the type of health insurance plan and the life event itself.

This easy guide will explain everything in plain English. You will learn what a qualifying life event is, what 30 days means, what 60 days means, and how to know which one applies to you. Even if this topic feels hard right now, don’t worry. By the end, it will feel clear and simple — even for beginners.

What Does Each Term Mean?

Let’s break this into two simple parts.

What Is a Qualifying Life Event?

A qualifying life event is a big change in your life that allows you to sign up for or change health insurance outside the normal enrollment period.

It is a noun phrase (a group of words acting like a noun).

Easy examples:

- You get married.

- You lose your job and health coverage.

- You have a baby.

Think of it like a special pass. When life changes suddenly, the insurance company gives you extra time to act.

What Does “30 Days” Mean?

30 days means you have one month after the life event to take action.

It is a time limit.

Easy examples:

- You lose coverage → you have 30 days to enroll.

- You move to a new state → you must act within 30 days.

- You miss 30 days → you may lose the chance.

What Does “60 Days” Mean?

60 days means you have two full months to enroll or make changes.

It is also a time limit, but longer.

Easy examples:

- You get married → you have 60 days to update your plan.

- You have a baby → you get 60 days to add the child.

- You act early → coverage can start sooner.

The Key Difference Between Qualifying Life Event 30 or 60 Days

The main difference is how much time you are given to act after a life event.

Comparison Table

| Feature | 30 Days | 60 Days |

|---|---|---|

| Time allowed | 1 month | 2 months |

| Common with | Employer plans | Marketplace plans |

| Stress level | Higher | Lower |

| Risk of missing deadline | High | Lower |

| Best action | Act fast | Still act early |

Quick Tip to Remember:

🧠 Employer plans often say “30.” Marketplace plans usually say “60.”

Common Mistakes and How to Avoid Them

Many people lose coverage because of small mistakes. Let’s fix them.

Mistake 1: Thinking All Plans Use 60 Days

❌ Wrong: “Every qualifying life event gives me 60 days.”

✅ Correct: Some plans allow only 30 days.

Why it happens: People hear about the marketplace rule and think it applies everywhere.

Fix: Always check your plan rules.

Mistake 2: Waiting Too Long

❌ Wrong: “I’ll do it later.”

✅ Correct: Act as soon as the event happens.

Why it happens: Life feels busy during big changes.

Fix: Set a reminder the same week.

Mistake 3: Counting Days Wrong

❌ Wrong: Counting from the end of the month.

✅ Correct: Count from the date of the event.

When to Use “30 Days”

Use 30 days when talking about shorter enrollment windows, usually tied to work plans.

Situations Where 30 Days Apply:

- Employer-sponsored health insurance

- Some job changes

- Certain company benefit policies

Simple Examples:

- I lost my job and have 30 days to enroll.

- My company allows 30 days after marriage.

- Missing 30 days can cancel coverage.

- HR told me the limit is 30 days.

- I acted within 30 days to stay covered.

When to Use “60 Days”

Use 60 days when talking about health insurance marketplaces or government plans.

Situations Where 60 Days Apply:

- ACA Marketplace plans

- Marriage

- Birth or adoption

- Loss of health coverage

Simple Examples:

- I have 60 days to sign up on the marketplace.

- After my baby was born, I got 60 days.

- The rule allows 60 days to enroll.

- I used my 60 days wisely.

- This event gives a 60-day window.

Memory Hack:

📆 Two months = Marketplace.

Quick Recap: Qualifying Life Event 30 or 60 Days

- A qualifying life event lets you change insurance.

- 30 days is common for employer plans.

- 60 days is common for marketplace plans.

- Missing the deadline can mean no coverage.

- Always check your plan details.

Advanced Tips (Optional)

A Little History

The 60-day rule became popular with the Affordable Care Act (ACA). Employer plans kept stricter timelines, often 30 days.

Formal Writing Use

In formal writing, always be specific:

- ✔ “The qualifying life event allows 60 days for enrollment.”

- ✘ “You get some extra time.”

Texting and Online Mistakes

Saying “30 or 60 days” without context can confuse readers. Always explain which plan you mean.

Mini Quiz: Test Yourself

Fill in the blanks:

- A marriage is a ________ life event.

- Marketplace plans usually allow ________ days.

- Employer plans may allow only ________ days.

- Missing the deadline can stop ________.

- Always check your ________ rules.

(Answers: qualifying, 60, 30, coverage, plan)

FAQs:

1. Is a qualifying life event 30 or 60 days?

It can be either. Marketplace plans usually allow 60 days, while employer plans often allow 30 days.

2. Why do some plans give only 30 days?

Employer plans set their own rules and often choose shorter deadlines.

3. Does losing a job give 60 days?

Yes, for marketplace coverage. Employer COBRA rules may differ.

4. Can I apply before the life event?

Sometimes yes, like before marriage. It depends on the plan.

5. What happens if I miss the deadline?

You may have to wait until the next open enrollment.

Conclusion

Now you clearly understand the qualifying life event 30 or 60 days rule. The key lesson is simple: the time limit depends on your plan. Some give 30 days, others give 60 days. Acting early is always the safest choice.

Life events can feel stressful, but knowing the rules gives you confidence. Take action fast, ask questions, and protect your coverage. Small steps like this help you make smarter choices every day.

Francis Sufford crafts thoughtful, insightful explanations on language, meaning, and usage, blending clarity with storytelling to guide readers effectively.