Many people get confused when they hear the terms refinance and home equity loan. Both are related to borrowing money using your home, but they work in different ways. Because the words sound complicated, people often mix them up or don’t know when to use each one. This simple guide will explain the meaning, difference, and correct usage of refinance / home equity loan in the clearest way possible.

You will learn what each term means, how they work, and which situation is best for refinance or a home equity loan. Every explanation is written in simple English so even a 4th-grade student can understand it. With examples, tables, tips, and memory tricks, this guide will make financial terms easy for everyone.

What Does Each Word Mean?

1. What Does Refinance Mean?

Refinancing means replacing your current loan with a new one—usually to get a lower interest rate, cheaper monthly payments, or better loan terms. It is like trading your old loan for a better one.

Part of speech: Verb (an action)

Easy Examples:

- “My dad refinanced our house to lower our monthly payment.”

- “You can refinance your loan if the interest rate goes down.”

- “She refinanced to save money every month.”

Think of refinancing like upgrading your old phone to a new one because the new one works better.

2. What Does Home Equity Loan Mean?

A home equity loan is money you borrow on top of your existing mortgage using the value of your home. You get a lump sum of cash and pay it back over time.

Part of speech: Noun (a type of loan)

Easy Examples:

- “He took a home equity loan to fix his roof.”

- “A home equity loan gives you money based on your home’s value.”

- “They used a home equity loan to pay for college fees.”

Think of it like borrowing money from the value already built in your home, like taking savings out of your house.

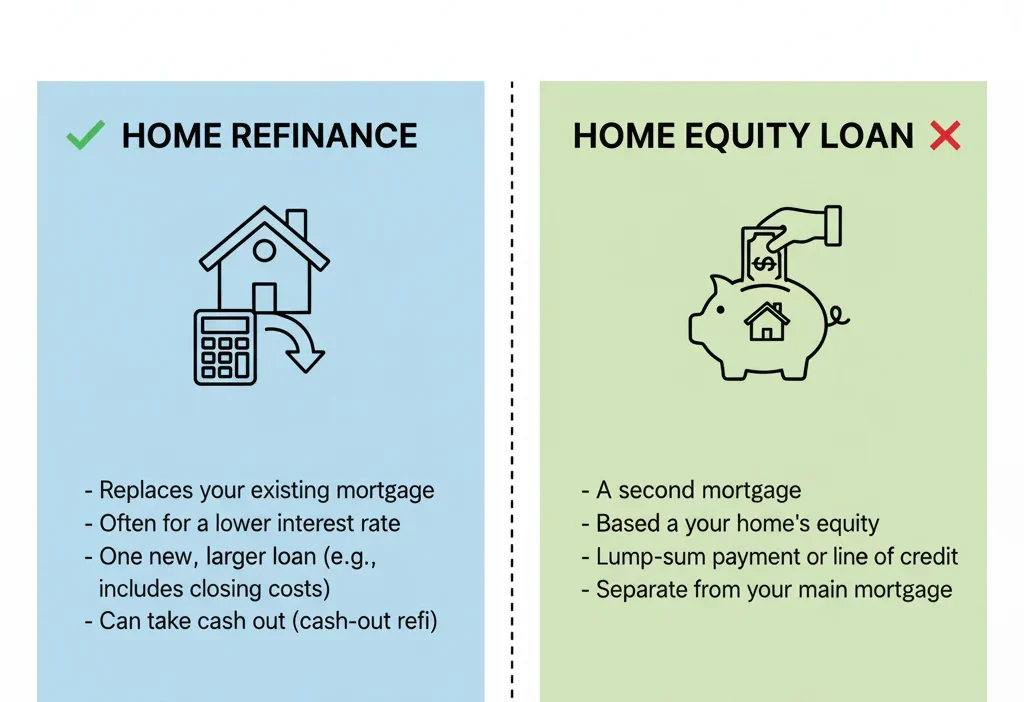

The Key Difference Between Refinance and Home Equity Loan

Here is the difference in the simplest form:

Refinance = Replace old loan

Home Equity Loan = Add new loan

You refinance to improve your current loan.

You take a home equity loan to borrow extra money.

Comparison Table: Refinance vs Home Equity Loan

| Feature | Refinance | Home Equity Loan |

|---|---|---|

| What it does | Replaces your current mortgage | Adds a second loan on top of your mortgage |

| Best for | Lowering interest or monthly payments | Borrowing extra cash |

| Money received | Usually none (unless cash-out refinance) | Yes, cash lump sum |

| Payments | One mortgage payment | Two loan payments |

| Example | “I refinanced to pay less.” | “I used a home equity loan for home repairs.” |

Quick Tip to Remember:

If you want better loan terms, choose refinance.

If you need extra money, choose home equity loan.

Common Mistakes and How to Avoid Them

❌ Mistake 1:

“Refinancing means getting extra money.”

Correction:

Refinancing only replaces your loan—unless it’s a special cash-out refinance, which works differently.

❌ Mistake 2:

“A home equity loan replaces your mortgage.”

Correction:

A home equity loan does not replace anything. It is an extra loan.

❌ Why These Mistakes Happen

People mix them because both involve a home and both involve borrowing. But their purposes are totally different.

Tip:

Think of refinance = fix loan

and

home equity loan = get money

When to Use Refinance

Use refinance when you want to improve or update your current loan. It is mainly about getting better terms, not extra cash.

Best Situations to Use Refinance:

- When interest rates drop

- When your monthly payment is too high

- When you want to shorten or extend your loan

- When you want to remove a high-interest loan

- When you want a more stable payment (from adjustable to fixed rate)

Example Sentences:

- “I refinanced my home to save money every month.”

- “They refinanced to switch from a 30-year loan to a 15-year loan.”

- “We refinanced because interest rates went down.”

- “She refinanced to remove her private mortgage insurance.”

- “My parents refinanced to make payments easier.”

When to Use Home Equity Loan

Use a home equity loan when you need to borrow money for a specific purpose. It is about getting extra cash based on your home’s built-up value.

Best Situations to Use a Home Equity Loan:

- Home repairs or remodeling

- Medical bills

- College tuition fees

- Starting a small business

- Paying off high-interest debt

Example Sentences:

- “He used a home equity loan to build a new kitchen.”

- “They took a home equity loan to pay for school.”

- “A home equity loan helped us cover medical expenses.”

- “She used a home equity loan to consolidate debt.”

- “We applied for a home equity loan to renovate the basement.”

Memory Hack:

A home equity loan gives you a bundle of money, like a gift box.

Quick Recap: Refinance vs Home Equity Loan

- Refinance = replace your current loan

- Home Equity Loan = get extra loan + cash

- Refinance = better interest, better terms

- Home equity loan = money for projects or bills

- Refinance fixes your old loan

- Home equity loan adds a second loan

Advanced Tips (Optional for Readers)

1. History of the Terms

“Refinance” comes from finance laws that allowed people to swap old debt for new terms.

“Home equity loan” became popular in the 1980s when homeowners wanted access to quick funds.

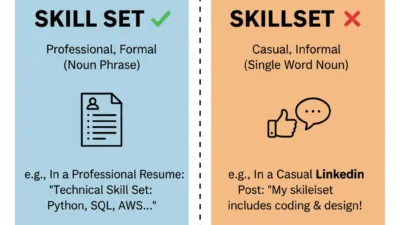

2. Formal Writing Usage

In essays, financial papers, and exams, always use the full terms:

- “Mortgage refinance”

- “Home equity loan financing”

3. Online or Texting Misuse

People often say “refi” for refinance.

They write “HEL” for home equity loan.

These are fine casually but not in formal writing.

Mini Quiz: Test Yourself!

Fill in the blanks using refinance or home equity loan:

- I want lower payments, so I will ______ my mortgage.

- She took a ______ to pay for her college fees.

- If rates go down, it is smart to ______.

- We used a ______ to fix our roof.

- He plans to ______ because his old loan is too expensive.

- They need extra cash for remodeling, so they chose a ______.

- A ______ replaces your existing loan.

(Answers: refinance, home equity loan, refinance, home equity loan, refinance, home equity loan, refinance)

5 FAQs

1. What is the main difference between refinance and a home equity loan?

Refinancing replaces your current mortgage, while a home equity loan gives you extra money without removing your old mortgage.

2. Is refinancing better than taking a home equity loan?

If you want better interest or lower payments, refinance. If you need cash, choose a home equity loan.

3. Do both options require home value?

Yes. Your home’s value affects both refinance approval and home equity loan amount.

4. Can I have both a refinance and a home equity loan?

Yes, many homeowners refinance first and then take a home equity loan later if needed.

5. Is a home equity loan risky?

Yes—if you cannot repay, your home may be at risk. Borrow only what you can manage.

Conclusion

Understanding the difference between refinance and home equity loan helps you make smart money choices. Refinance is best when you want lower payments or better loan terms. A home equity loan is useful when you need extra cash for big expenses like repairs or school fees. Now that you know their meanings, when to use them, and how they work, you can choose the option that fits your situation. Keep learning simple financial terms, and you’ll become more confident in making financial decisions every day.

Jenn Ashworth offers clear, engaging explanations of language and usage, helping readers grasp meanings, nuances, and differences with accuracy and ease.