A refinance replaces your existing mortgage with a new one, often to get a lower interest rate or change loan terms. A home equity loan is a separate loan using your home’s equity as collateral, usually for big expenses. Knowing the difference helps you choose the right option for your finances.

Many homeowners often confuse refinance or home equity loan because both involve borrowing against your house. But using them incorrectly can cost you money and stress.

In this guide, you’ll learn the meanings, differences, correct usage, and practical examples of each term. By the end, even a beginner can confidently decide whether to refinance their mortgage or take a home equity loan. We’ll also cover common mistakes, usage tips, and memory hacks to make the concepts stick.

What Does Each Word Mean?

Refinance

- Definition: To replace your current mortgage with a new one, usually to lower your interest rate or change repayment terms.

- Part of Speech: Verb (action you take on your mortgage)

Examples:

- Sarah decided to refinance her home to get a lower interest rate.

- Many people refinance to switch from an adjustable-rate mortgage to a fixed-rate mortgage.

- He refinanced his loan to reduce monthly payments.

Memory Tip: Think of “refinance” as “re-doing your mortgage.”

Home Equity Loan

- Definition: A loan taken against the equity of your home, giving you a lump sum of money for big expenses.

- Part of Speech: Noun (a type of loan)

Examples:

- They took a home equity loan to pay for kitchen renovations.

- A home equity loan can cover tuition or medical bills.

- The bank approved her home equity loan for a new car.

Memory Tip: Think of a home equity loan as “borrowing from your home’s value.”

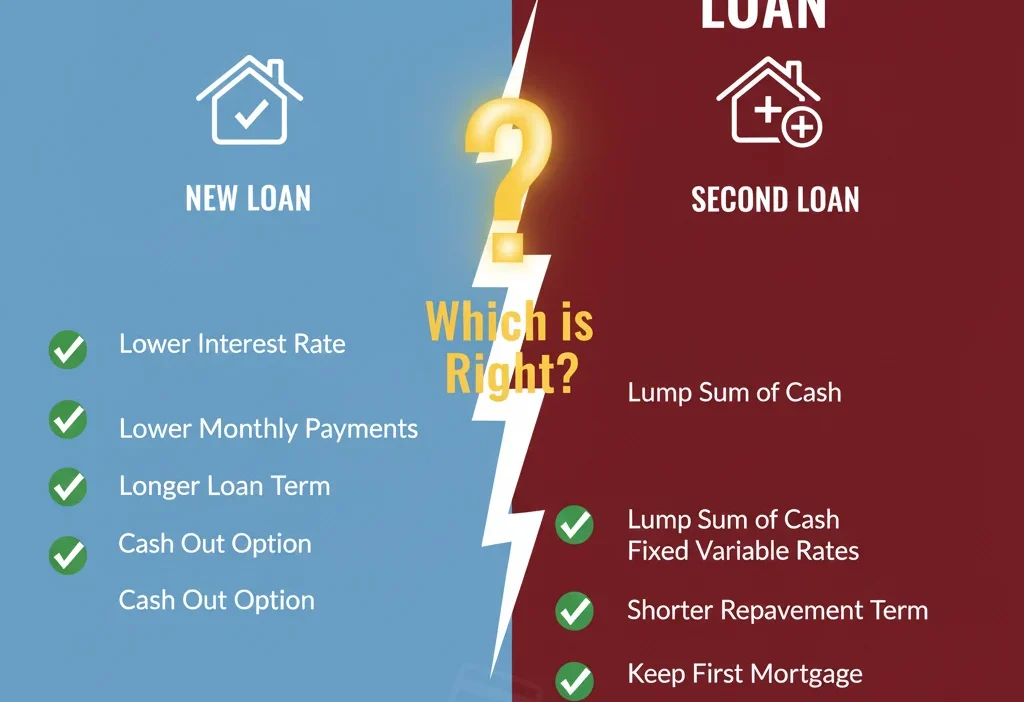

The Key Difference Between Refinance and Home Equity Loan

| Feature | Refinance | Home Equity Loan |

|---|---|---|

| Definition | Replace your existing mortgage | Borrow a separate loan using equity |

| Purpose | Lower interest, change terms | Access cash for big expenses |

| Loan Type | Primary mortgage | Second loan |

| Repayment | Monthly mortgage payments | Monthly loan payments |

| Example | Refinanced to a 15-year mortgage | Home equity loan for college fees |

Quick Tip: If you want to replace your mortgage → refinance. If you want extra money without changing your mortgage → home equity loan.

Common Mistakes and How to Avoid Them

Mistake 1: Thinking refinancing always gives cash out.

- ❌ Incorrect: “I refinanced to pay for a vacation.”

- ✅ Correct: “I took a home equity loan to pay for a vacation.”

Mistake 2: Using home equity loan to lower your mortgage interest rate.

- ❌ Incorrect: “I got a home equity loan to refinance my mortgage.”

- ✅ Correct: “I refinanced my mortgage for a lower rate.”

Mistake 3: Mixing terms in financial discussions.

- ❌ Incorrect: “I want to refinance my home equity loan.”

- ✅ Correct: “I want to refinance my mortgage or take a home equity loan.”

Why it happens: Both involve your home, so people assume they’re the same. The fix is remembering: refinance = replace; home equity = extra loan.

When to Use Refinance

Refinancing is ideal when you want to:

- Lower your interest rate and reduce monthly payments

- Shorten or extend the mortgage term

- Switch from adjustable to fixed-rate mortgage

- Consolidate higher-interest debt (sometimes with cash-out refinance)

Examples:

- John refinanced to get a 3% interest rate instead of 5%.

- Maria refinanced her 30-year mortgage into a 15-year plan.

- We refinanced to lower our monthly payment.

- He refinanced to change from adjustable to fixed rate.

When to Use Home Equity Loan

Home equity loans are best for:

- Home renovations

- Paying tuition or medical bills

- Buying a car or funding major expenses

- Consolidating debt without touching your mortgage

Examples:

- They took a home equity loan to renovate the bathroom.

- A home equity loan helped pay for college tuition.

- We borrowed from our home equity to start a small business.

- She used a home equity loan to consolidate credit card debt.

Memory Hack: Imagine your home as a piggy bank. Home equity loans let you borrow from it without changing your mortgage.

Quick Recap: Refinance vs Home Equity Loan

- Refinance: Replace your mortgage, lower interest, or change terms

- Home Equity Loan: Extra loan using home equity, separate from mortgage

- Tip: Refinance = replace. Home equity = borrow extra cash.

- Common mistake: Mixing cash-out with regular refinancing

Advanced Tips

- Origin: “Refinance” comes from Latin roots meaning “to finance again.”

- Formal use: Refinancing is common in mortgage documents, banks, and financial essays.

- Casual writing: People often confuse the two in text messages. Example: “I refinanced my equity loan” is incorrect.

Mini Quiz

Fill in the blanks with refinance or home equity loan:

- I decided to _______ my mortgage to get a lower interest rate.

- They took a _______ to pay for their daughter’s college tuition.

- If you want extra money without changing your mortgage, use a _______.

- We chose to _______ to shorten the loan term.

- A _______ can help fund home renovations safely.

FAQs

- What’s the difference between refinance and home equity loan?

- Refinance replaces your mortgage; home equity loan is a separate loan using your home’s equity.

- Can I get cash through refinancing?

- Yes, a cash-out refinance allows it, but standard refinancing usually just changes loan terms.

- Is a home equity loan risky?

- Only if you fail to repay. Your home is collateral.

- Which is better: refinance or home equity loan?

- It depends on your goal: lower mortgage payments → refinance; get extra cash → home equity loan.

- Can I do both at the same time?

- Yes, but it’s complex. Usually, homeowners pick one based on financial needs.

Conclusion

Understanding refinance or home equity loan is crucial for making smart financial decisions. Refinance your mortgage to lower rates or change terms, and use a home equity loan to access cash for big expenses. Remember: refinance = replace mortgage; home equity = borrow extra money.

By practicing these distinctions with real-life examples, you’ll quickly master the difference. Every correct usage brings you closer to financial confidence and smarter money choices. Keep learning and applying these terms in everyday situations!

Gwendoline Riley delivers clear, compelling insights into language and usage, helping readers understand meanings, nuances, and differences with confidence.